- +41 58 307 05 55 (Europe)

- +1 305 728 53 69 (America)

- info@bestvision.group

INTERNET BANKING

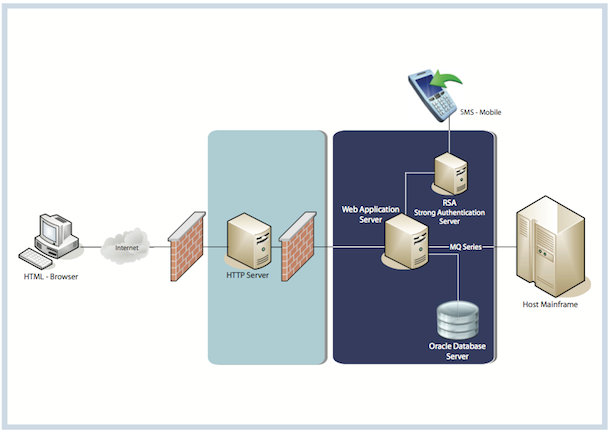

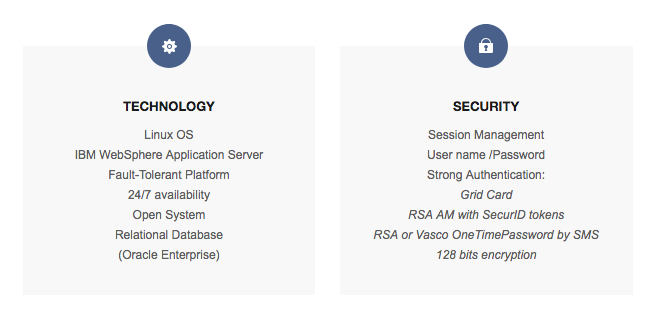

The independent Internet banking system provided by BEST E-Banking satisfies the needs of both private and professional users as, for instance, asset managers. Thanks to its modular design, numerous extensions are available, ranging from a simple portfolio presentation to a complete portal style application including payments and securities transactions. The system is designed to be operated 24/7 independently from the core banking system that can be smoothly integrated thanks to the existing interfaces.

BEST E-Banking allows customers to gain simple and secure access to their portfolio data from any location. Customers can order and print asset statements or other documents at any time. The payments and securities transactions modules include numerous features, as voucher readers, data import and export, standing orders for payments or automatic order generation for securities. The highest level of security for the end user is ensured by the integration of leading strong authentication solutions using tokens or cellphones.

FUNCTIONALITIES

Portfolio

Payments

Securities

Administration

Portfolio

Portfolio enquiries

The central portfolio view shows all asset positions organised by investment type. The assets are hierarchically structured, details are accessible at a simple mouse click. Each bank licensing the product can personalise the data to be presented for each investment type.

Asset statements

Internet users can create asset statements online. Various summaries can be selected, as distribution by investment category, by currency, economical sector, etc.

Assets values are displayed both in the position currency and the customer reference currency. Graphic and charts complete the presentation with visual overviews.

Positions and bookings

For each asset position, the total value in the reference currency, the average buy price and the current gain/loss are always present. The portfolio positions are always current and updated thanks to the real-time interface with the core banking system. Account balances are also updated immediately when a new transaction is booked, thanks to this real-time messaging principle.

Additional functions

For professional asset managers, several customers and their portfolios can be included in the same e-banking contract allowing consolidated asset views. The integrated secure messaging module allows exchanging information with the bank via a protected and confidential channel.

Payments

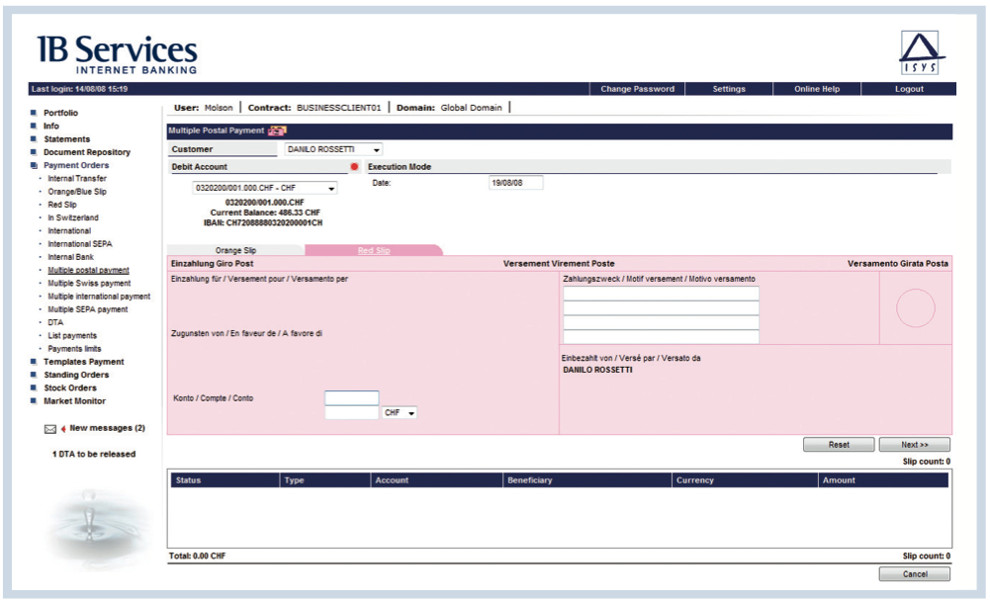

The input of domestic and foreign payments is facilitated by search and library functions for recurring payments. Electronic payment voucher readers and automatic transactions import in DTA format are supported. The basic functions also include transfers of general ledger accounts and of standing orders. For all payments it is possible to apply a double verification, eventually activated only for payments predefined amounts.

Domestic and foreign payments

All the needed functions for Swiss domestic as well as SWIFT-based foreign payment transactions are available. The input screens reproduce the classic slips, red and orange types, for postal payments. For SIC payments, the receiving bank can be searched by name or by code. The same search function is made available for international payments, through a SWIFT address database. Payments can be loaded in advance and will remain in “pending” status until the execution date. Any payment, which has not been executed yet, can be modified directly by the customer, reducing the calls to the bank and back office charges.

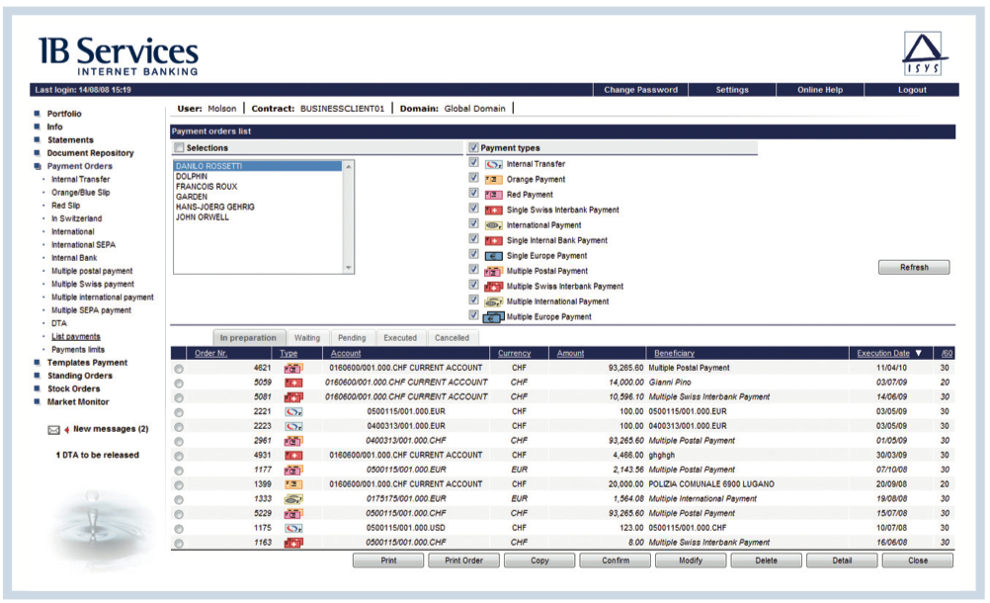

Order monitoring

The advancement of payment orders can be monitored through the dedicated screens. Order monitoring displays the current status of all loaded payments (in preparation, pending, executed, cancelled). Payments with the status “in preparation” or “pending” can be still changed or cancelled. A number of selection and sorting criteria is available to search for specific orders. All payment orders can be printed out individually or as a collective list.

Standing orders

Standing orders are used for periodic payments to be sent at regular intervals. The effective payments are automatically generated a few days before the execution date. They then remain in “pending” status, allowing the customer to check them before the execution date and to amend them, or cancel them, if necessary.

Securities

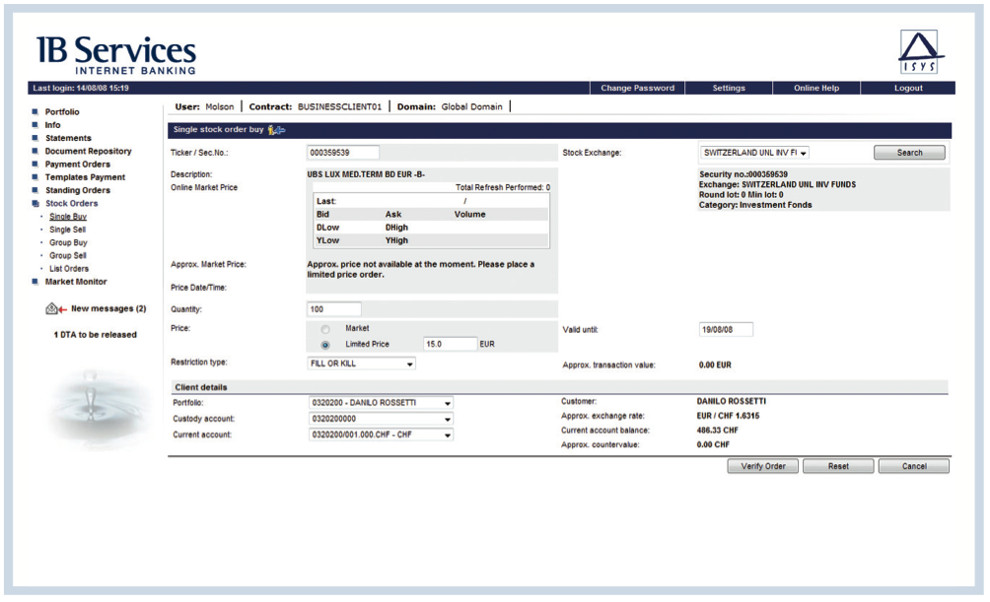

The trading of securities is available in the application both for individuals and for professional asset managers who need to create block orders for many portfolios. The real-time monitoring of the order execution and the integration of a market price feed complete the module.

Stock exchange orders

The bank can decide to restrict the type of securities that can be traded via Internet. The security search function allows using different criteria: stock exchange, security type, name, ISIN or Telekurs. Once a security is selected, and with market price feed connected, all associated financial information is displayed in real time. The supported securities orders include market, limited, stop-loss, stop-limit securities. When an order is entered, the indicative transaction value is always displayed. The proposed debit/credit account is displayed with its current balance to check the order financial covering.

Order monitoring

All security orders loaded are presented with their current status “pending”, “fully executed”, “partially executed”. The details of all pending and executed orders remain accessible. The cancellation is possible for any still pending or partially executed orders.

Asset management

For external asset managers, several customers can be managed within a single e-banking contract. In such a contract the different customers and portfolios can be grouped according to their investment profile, investment strategy or any criteria relevant for the asset manager. Once such a group is activated the asset manager can create orders for the whole group. These block orders can be generated automatically by the system applying specific targets: the position increase of 10%, the stock compartment increase up to 25%, etc.

For block orders, the double confirmation can be activated, requiring the go-ahead of a second user before the order is sent to the bank.

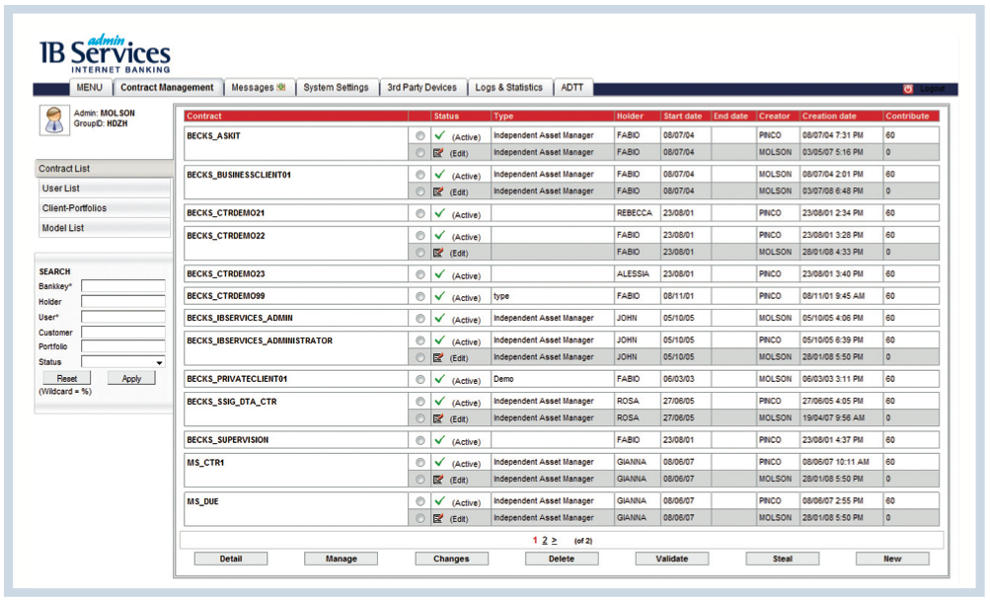

Administration

The Administration application is designed to warrant the fast and efficient opening of e-banking contracts. The application allows defining the content of a contract, the users who can access and the related rights and limitations.

Contract and user administration

For private and retail customers the eBanking contracts are often very simple: only one user, one portfolio without restrictions of functions. For asset managers and companies, the contract definition can be more complex, with numerous users with specific rights of input or of control, as well as many different customers and portfolios in a single contract.

Access rights

Access rights can be defined for each user and for each contract: e.g. portfolio enquiries, payment input up to a maximum amount, securities trading. It is also possible to define the amounts levels that would make the approval by a second user mandatory. Standard access rights models can be defined and stored in the system. This allows the fast and efficient opening of both s imple and complex contracts.

Limit management

The module gives the users the possibility of defining daily or monthly limits for the payments sent via Internet, or for securities orders. If the limit is exceeded, the orders will still be stored but they must be unlocked by another user or when the limit is no more exceeded.

Integration of strong authentication solutions

The Administration application is interfaced with different leading strong authentication systems: RSA, Vasco, Entrust. This allows avoiding the usage of external consoles for the attribution of SecurID tokens or other securirty devices: all the needed functions and features are already available in the Administration application. This includes the password reset, replacement of devices, activation and de-activation.