- +41 58 307 05 55 (Europe)

- +1 305 728 53 69 (America)

- info@bestvision.group

BEST IRS

What is important in the reporting activities of forms 1042 and 1042-s?

Produce correct forms and respect the deadlines. We can all agree with that.

What if you could take advantage of a solution that can guarantee what above as well as make you save time and reduce your reporting risks?

How can you have that?

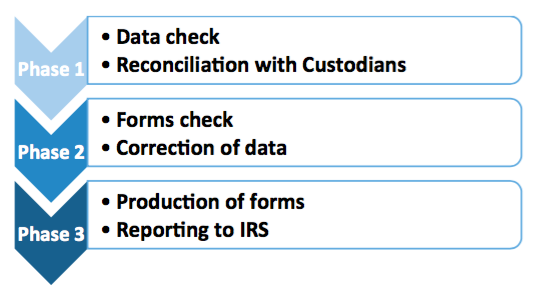

Through BEST IRS. This is our solution, specifically designed to satisfy the QI needs of reconciliation with custodians, check and validation of data and ultimately produce and send forms 1042, 1042-s to the IRS.

Is BEST IRS a “good” solution for QIs?

If you want a solution that allows you to properly and efficiently manage your reporting to the IRS, the answer is surely YES. Since 2002, we support financial institutions to comply with their QI reporting needs. Through the automation, we reduce the risk of reporting mistakes in forms 1042 and 1042-S and, at the same time, we reduce sensibly the time spent on these activities.

Quality reports saving up to 80% of your time.

What does BEST IRS offers?

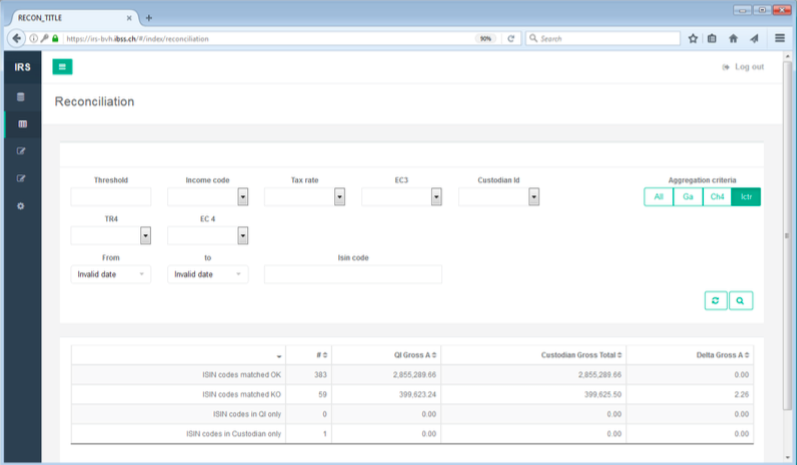

- Reconciliation functionalities

- Automatic checks

- Production of 1042, 1042-s forms

- Compliance functionalities

- Reports for QI’s institutional clients

Here you can download our Brochure.

To receive more info, contact us.

What is the price of the BEST IRS services?

The solution is so flexible that we are currently offering it to different type of QIs: from large groups of banks to single small financial entities.

We would be pleased to provide you all the information you may need regarding our services, so please do not hesitate to contact us.

Give us the opportunity to help you solve all of your QI reporting needs.

For detailed information about the solution for QI click here.